Discover why the government’s hydrogen roadmap makes Souss‑Massa a prime spot for energy ventures—and how DBS structures funding and partnerships to get you in early.

1. Why Souss‑Massa Is the Next Green Hydrogen Hotspot

Morocco’s south is renowned for citrus and tourism—but few know that Souss‑Massa combines three rare ingredients for scaled green hydrogen production:

Strategic port access via Agadir and nearby Essaouira

World‑class wind speeds (7–9 m/s) along the Atlantic coast

Abundant solar irradiation (> 3,200 hours/year) in inland plains

2. Morocco’s National Hydrogen Roadmap: What It Means for Souss‑Massa

In January 2024, Morocco unveiled a bold plan to produce one million tonnes of green hydrogen by 2030. Key pillars:

- Financial incentives: feed‑in tariffs for hydrogen, tax breaks for electrolyzer imports

- Infrastructure upgrades: repurposing LPG pipelines, deepening Agadir port

- Regulatory clarity: streamlined permitting, guaranteed offtake to utilities and industry

Why Souss‑Massa?

It’s officially listed as a priority “hydrogen corridor” in government gazettes.

It ticks all roadmap boxes: renewables, storage, export.

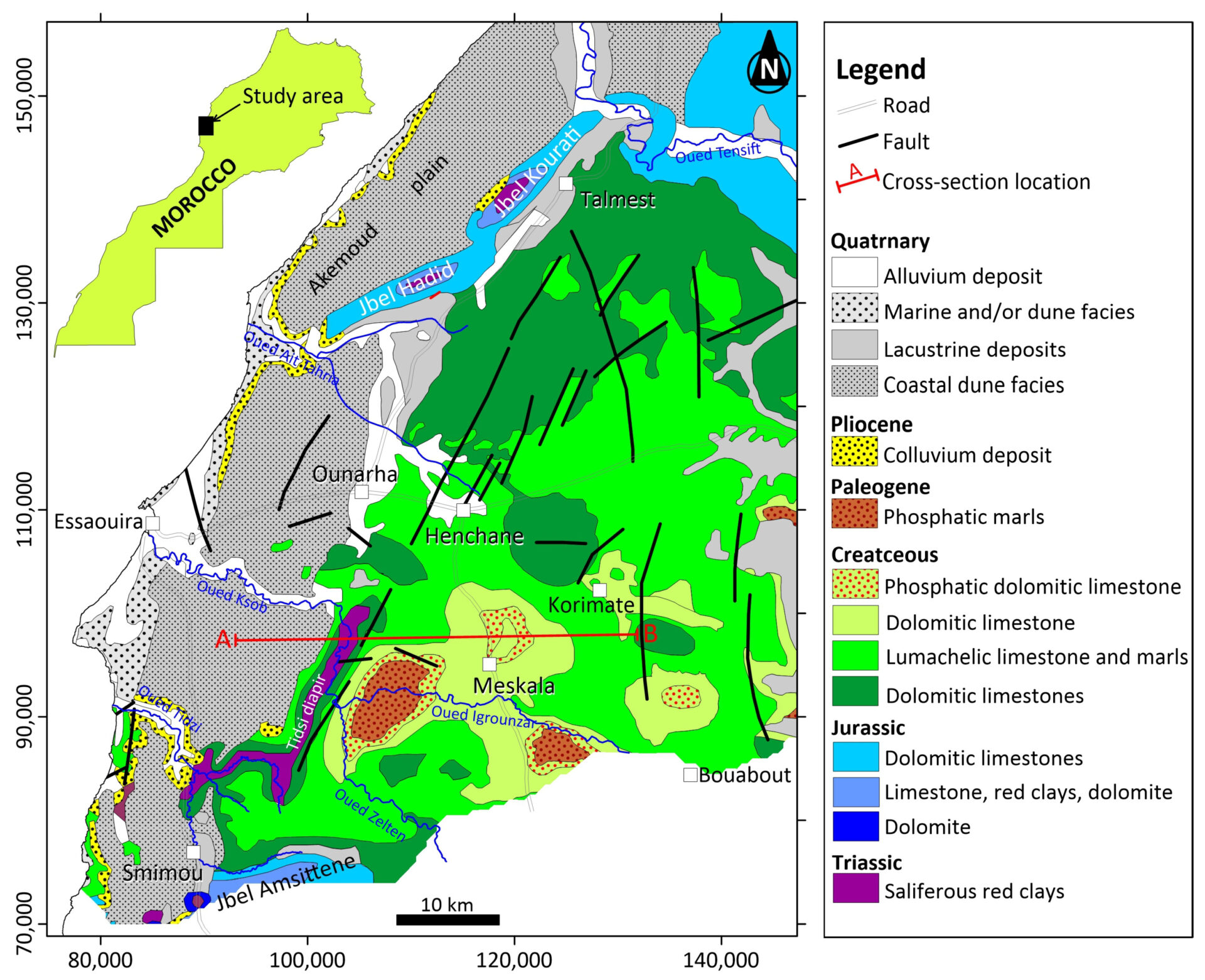

3. Salt Domes at Essaouira: Nature’s Hydrogen Vaults

Producing hydrogen is only half the story—storing it is crucial. In 2023, Sahara Wind mapped one of Africa’s largest salt‑dome formations near Essaouira. Benefits:

- High‑pressure cavern storage with near‑zero leakage

- Seasonal arbitrage: store excess in winter, dispatch in summer

- Scale: capacity to hold hundreds of thousands of tonnes

Connected to underused LPG pipelines, these domes transform Souss‑Massa into an invisible energy bank.

4.Western Sahara’s $3 Billion Green Hydrogen Push

Mid‑2024 saw six major hydrogen/ammonia projects approved across southern provinces, including Western Sahara, totaling $3 billion. Focus areas:

- Green ammonia bunkering for shipping

- Zero‑carbon fertilizer replacing grey ammonia

- Export terminals in Laayoune & Dakhla

Investor considerations:

- Political sensitivity: structuring SPVs with local partners

- Logistical hurdles: off‑grid power + microgrid backup

Multi‑jurisdiction compliance: Moroccan law, UN resolutions, EU import rules

5. Fortescue + OCP JV: The Manufacturing Game‑Changer

In late 2024, Fortescue Metals Group and OCP Group launched a $750 million joint venture to build green hydrogen, ammonia, and fertilizer capacity at Jorf Lasfar. Highlights:

- Vertical integration: electrolyzers co‑located with phosphate mines

- Robust financing: VC‑style capex backed by strategic investors

- Export readiness: terminals for Africa and Europe

DBS Insight: We pre‑structure project finance vehicles, nail down offtake, and coordinate EPC for swift execution.

6. Beyond Power: Cross‑Sector Venture Synergies

Green hydrogen in Souss‑Massa unlocks multiple adjacent ventures:

Carbon capture: turning waste CO₂ into synthetic fuels

H₂‑fueled transport: fuel‑cell buses, port cranes

Industrial heat: ceramics, glass, food processing

Desalination: off‑grid H₂‑powered RO plants

Five Quick‑Win Opportunities Today

The Souss Massa region, with its central city of Agadir, offers significant opportunities in the real estate sector. This area is known for its natural beauty, growing infrastructure, and tourism potential. Here are key reasons why real estate investment in Souss Massa is promising:

- Pilot Salt‑Dome Storage Rights: Secure cavern leases now.

- Portside Logistics Facility: Develop a small DH₂ terminal at Agadir.

- Green Ammonia Micro‑Plant: Co‑build a 5 MW trial near phosphate sites.

- H₂‑Bus Fleet Pilot: Partner with local transit authorities.

- Off‑Grid Desalination: Bundle solar, wind, and hydrogen for remote villages.

From Hidden Potential to Heroic Ventures

Green hydrogen in Souss‑Massa is more than an energy story—it’s a launchpad for cross‑sector ventures that reshape transport, industry, water, and carbon management. With DBS’s risk‑aware frameworks, politically smart structuring, and venture‑building expertise, you’ll be at the forefront of the next great Moroccan energy revolution.

Don’t just watch the tide—ride it.

Join DBS and build the future of clean energy—in Souss‑Massa and beyond.

How to Apply for Incentives

Investors wishing to benefit from government incentives must follow a specific application process. These incentives can include tax breaks, financial grants, or reduced customs duties.

The Moroccan Investment company (DBS Morocco) is responsible for guiding foreign investors through this process, ensuring they meet the necessary eligibility criteria.

Morocco’s robust legal framework, investment incentives, and strategic location make it a compelling destination for international investors.

From the renewable energy and agriculture sectors to tourism and real estate…, the country offers a wide range of opportunities for smart and forward-thinking investors.

If you’re considering expanding your investment portfolio, Morocco should be at the top of your list. Whether you are a seasoned investor or just starting, DBS Morocco is here to guide you every step of the way.

Our team of experts can help you navigate Moroccan investment laws, access incentives, and set up a successful business in Morocco’s thriving economy.

Ready to make your investment in Morocco? Contact DBS Morocco today and take the first step towards a profitable and secure investment in one of Africa’s most promising markets!