Moroccan Investment Laws

1. Moroccan Investment Laws Landscape

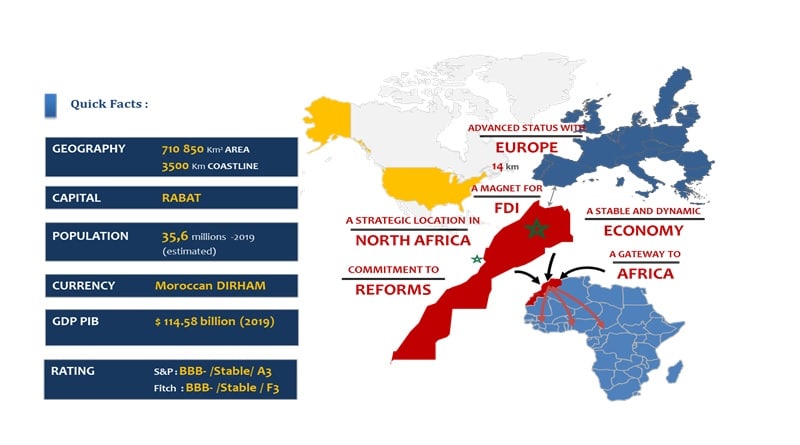

Morocco has quickly become one of the most attractive investment destinations in Africa, thanks to its strategic location, stable political environment, and rapidly developing economy.

Investors from around the world are drawn to the country’s diverse opportunities, including agriculture, tourism, renewable energy, and more.

For international investors, understanding the local investment laws and incentives is crucial to making informed and profitable decisions.

In this guide, we will explore the key aspects of navigating Moroccan investment laws and incentives, making it easier for you to enter the Moroccan market with confidence.

2. Key Moroccan Investment Laws

Overview of Major Laws Moroccan Investment Laws

Morocco has a well-defined legal framework that governs foreign investments. The most important piece of legislation is the Moroccan Investment Charter, which guarantees fair treatment for all investors, including foreign nationals.

This charter covers various aspects such as the right to repatriate profits and protection against expropriation.

What Foreign Investors Should Know

If you’re a foreign investor, there are specific legal requirements to consider. For example, non-Moroccan citizens must adhere to local regulations regarding property ownership, foreign exchange controls, and tax obligations. It’s crucial to consult legal professionals to ensure compliance with all Moroccan laws.

3. Types of Business Entities in Morocco

Setting Up a Limited Liability Company (SARL)

One of the most popular business structures in Morocco is the Société à Responsabilité Limitée (SARL), or Limited Liability Company. This type of company requires a minimum of two shareholders and offers limited liability, meaning investors are only liable for the amount they’ve contributed to the business.

Other Common Business Structures

Apart from SARL, investors can choose from other business structures such as joint-stock companies (SA) or partnerships. Each structure has its own advantages depending on the nature and size of the investment.

4. Investment Incentives in Morocco

Government Programs and Support

The Moroccan government actively encourages foreign investment through a variety of programs. These include investment subsidies, tax relief, and financial support for infrastructure development.

The government also provides special incentives for sectors such as agriculture, renewable energy, and manufacturing…

Tax Benefits for Foreign Investors

One of the major attractions for investors is Morocco’s favorable tax regime. Foreign investors can benefit from corporate tax exemptions, VAT reductions, and even customs duty exemptions for certain sectors.

5. The Role of the Moroccan Investment Development Agency (AMDI)

How AMDI Supports Investors

The Moroccan Investment Development Agency (AMDI) plays a critical role in promoting and facilitating investment. AMDI offers valuable resources, including market research, industry reports, and assistance with business registration. It also cares about the personal side of its investors..

Services and Tools Available for Investors

Through AMDI, investors can access services such as investment project consultations, matchmaking with local partners, and legal support.

6. Legal Protections for Investors

Morocco’s Bilateral Investment Treaties

Morocco has signed over 60 bilateral investment treaties (BITs) with various countries, ensuring protection for international investors. These treaties offer protection against unfair treatment and ensure compensation in the event of expropriation.

Property and Contractual Protections

Investors in Morocco are guaranteed full protection of their property rights, including intellectual property. In addition, Morocco’s legal system provides a robust framework for enforcing contracts, making it a secure environment for foreign investment.

7. Investment Opportunities in Key Sectors

1. Real Estate

The Souss Massa region, with its central city of Agadir, offers significant opportunities in the real estate sector. This area is known for its natural beauty, growing infrastructure, and tourism potential. Here are key reasons why real estate investment in Souss Massa is promising:

- Tourism-Driven Demand: Agadir is a leading tourist destination in Morocco, renowned for its beaches, resorts, and year-round pleasant weather. This drives demand for vacation homes, resorts, and hotels. Investors can capitalize on the rising number of domestic and international tourists by investing in tourist accommodations.

- Affordable Housing: There is a growing need for affordable housing in the region as the population expands and the urbanization process accelerates. Real estate developers can benefit from government incentives aimed at promoting housing projects for the middle class and lower-income groups.

- Agricultural Investment Growth: Souss Massa is an agricultural hub, with a strong demand for industrial and logistical infrastructure to support agribusiness. This includes warehouses, processing plants, and cold storage facilities. Real estate investment in this sector offers high returns due to the region’s export activities, especially in citrus fruits and vegetables.

- Eco-Tourism and Sustainable Development: The region’s rich natural landscapes, including the Atlas Mountains and nearby national parks, are perfect for eco-tourism projects. Sustainable real estate developments, such as eco-lodges and green hotels, are becoming increasingly attractive to environmentally-conscious tourists and investors.

2. Textile Sector

The textile industry in Souss Massa is emerging as a key area for investment due to the region’s industrial growth and strategic location. The sector offers opportunities for both local and foreign investors in several ways:

- Growing Industrial Zones: Souss Massa has seen the development of several industrial zones, where textile manufacturing facilities can be set up with access to modern infrastructure. These zones provide logistical support, transportation, and government-backed incentives for investors in the textile sector.

- Proximity to Major Ports: The region’s proximity to the Agadir port, which is a major export hub, allows for efficient shipment of goods to European markets. Investors can benefit from reduced transportation costs and faster access to international markets, making Souss Massa an ideal location for textile manufacturing aimed at exports.

- Sustainable and Eco-Friendly Production: There is a global shift towards more sustainable textile production, and Souss Massa has the potential to become a hub for eco-friendly textile manufacturing. Investing in organic fabrics, sustainable dyeing techniques, and energy-efficient production processes can help position companies in the region as leaders in the eco-textile industry.

- Skilled Labor Force: Souss Massa offers a skilled yet affordable labor force, making it attractive for textile companies looking to produce high-quality goods at competitive costs. Government initiatives focused on vocational training in the region ensure a continuous supply of skilled workers for the textile sector.

3. Agriculture

Souss Massa is a major agricultural hub in Morocco, known for its fertile lands and favorable climate. The region produces a significant portion of the country’s agricultural exports, including citrus fruits, vegetables, and olives. Investment opportunities in this sector are vast:

- Agri-Tech and Modernization: There is increasing demand for technological advancements in agriculture, such as precision farming, irrigation technologies, and automated harvesting systems. Investors can introduce innovative agricultural solutions to enhance productivity and sustainability.

- Agro-Processing: With the large volume of agricultural produce in Souss Massa, there is a strong potential for investment in agro-processing facilities. These include fruit and vegetable processing, packaging, and the production of value-added products for both local and export markets.

- Export-Oriented Agriculture: The region’s proximity to the Agadir port makes it ideal for export-driven agricultural investments. Investors can focus on growing high-demand crops for export markets, particularly citrus fruits and organic products, which are popular in Europe and beyond.

- Sustainable Farming: There is growing interest in organic farming and sustainable agricultural practices in the region. Investors can explore opportunities in organic produce, eco-friendly farming methods, and soil conservation projects that align with global trends in sustainability.

4. Tourism

Tourism is one of the most vibrant sectors in Souss Massa, with Agadir serving as a top tourist destination in Morocco. The region’s natural beauty, coastal resorts, and cultural heritage offer substantial investment potential:

- Beachfront Resorts and Hotels: Agadir’s stunning coastline is a magnet for tourists, and there is high demand for quality accommodation. Investment in luxury resorts, boutique hotels, and beachfront properties can yield significant returns, particularly as tourism continues to recover post-pandemic.

- Eco-Tourism: Souss Massa’s diverse ecosystems, including national parks and the nearby Atlas Mountains, offer opportunities for eco-tourism ventures. Investors can develop eco-lodges, hiking tours, and nature-based activities that cater to environmentally-conscious travelers.

- Cultural and Adventure Tourism: Beyond the beaches, Souss Massa is rich in culture and history. Investment in cultural tourism, such as heritage tours, local crafts, and culinary experiences, can attract tourists seeking authentic Moroccan experiences. Adventure tourism, including activities like trekking, mountain biking, and surfing, is also a growing sector.

- Health and Wellness Tourism: With the rise of wellness tourism globally, Souss Massa’s serene environment makes it ideal for wellness retreats, spas, and health-oriented resorts. Investment in this niche can attract visitors looking for relaxation, rejuvenation, and health treatments.

8. Navigating the Moroccan Tax System as an Investor

Key Tax Laws Affecting Investors

Morocco’s tax system offers multiple incentives for foreign investors, including corporate tax breaks and exemptions in many sectors.

Investors must familiarize themselves with Moroccan tax laws to maximize these benefits.

Filing Taxes in Morocco

All businesses operating in Morocco must file taxes annually. The tax authorities provide online platforms to make the process smoother for foreign investors.

Hiring a local accountant or legal advisor can simplify tax filing and ensure compliance with Moroccan regulations.

9. Financial Assistance and Credit Lines for Investors

Accessing Bank Loans

Moroccan banks offer various loan options tailored to foreign investors. Credit lines and investment loans can be secured from both local and international banks operating in Morocco.

Investors should carefully review the terms and conditions to select the most suitable financing options.

This is where DBS Morocco also plays a role as your investment partner, helping you secure the best financing that aligns with your investment goals.

Government Financing Initiatives

The Moroccan government also provides low-interest loans and grants for projects in strategic sectors, such as renewable energy and industrial manufacturing…

10. Labor Laws in Morocco

Hiring Workers in Morocco

One of the critical aspects of establishing a business in Morocco is adhering to the local labor laws. The labor market is regulated by the Moroccan Labor Code, which defines the rights and obligations of both employers and employees.

Companies must ensure that all contracts comply with local regulations and that workers receive their entitlements, including wages, benefits, and paid time off.

Understanding Morocco’s minimum wage requirements, social security contributions, and labor rights is essential for smooth operations.

Key Labor Laws Foreign Investors Should Know

Foreign investors must be aware of specific labor laws, including regulations concerning working hours, overtime pay, and employee dismissal.

The Moroccan government also encourages businesses to promote fair employment practices, including gender equality and workplace safety standards.

Companies planning to hire expatriates must also navigate Morocco’s work visa requirements and employment permits.

11. Real Estate and Infrastructure for Investors

Acquiring Property in Morocco

Foreign investors looking to acquire property in Morocco must be aware of the legal frameworks governing real estate purchases.

While Morocco offers attractive opportunities in commercial real estate, such as office spaces and factories, there are specific rules for foreign ownership of agricultural land.

Investors must work with local legal experts to navigate the purchase or lease of property, ensuring they comply with all laws and regulations.

12. Risks and Challenges of Investing in Morocco

Understanding Legal and Political Risks

Like any foreign investment, doing business in Morocco comes with certain risks. These can range from political changes to potential regulatory hurdles.

While Morocco enjoys relative political stability compared to other countries in the region, investors should stay informed about local political dynamics, especially when dealing with sectors closely tied to government policy, such as energy and infrastructure.

How to Mitigate Investment Challenges

To mitigate risks, investors should perform thorough due diligence, partner with reliable local consultants, and leverage Morocco’s extensive network of bilateral investment treaties (BITs).

These treaties provide safeguards for foreign investors, ensuring protection against expropriation and discrimination.

Additionally, working with investment company and participating in industry associations can help investors navigate the complexities of the Moroccan market.

13. Step-by-Step Guide to Establishing a Business in Morocco

Legal Registration Process

The process of setting up a business in Morocco involves several legal steps, starting with choosing the appropriate business structure (SARL, SA, or others).

Investors must register their business with Morocco’s Commercial Court and obtain a tax identification number.

This process typically involves submitting documents such as the company’s articles of association, proof of capital, and identification documents of shareholders.

How to Apply for Incentives

Investors wishing to benefit from government incentives must follow a specific application process. These incentives can include tax breaks, financial grants, or reduced customs duties.

The Moroccan Investment company (DBS Morocco) is responsible for guiding foreign investors through this process, ensuring they meet the necessary eligibility criteria.

Morocco’s robust legal framework, investment incentives, and strategic location make it a compelling destination for international investors.

From the agriculture and tourism sectors to renewable energy and real estate…, the country offers a wide range of opportunities for smart and forward-thinking investors.

If you’re considering expanding your investment portfolio, Morocco should be at the top of your list. Whether you are a seasoned investor or just starting, DBS Morocco is here to guide you every step of the way.

Our team of experts can help you navigate Moroccan investment laws, access incentives, and set up a successful business in Morocco’s thriving economy.

Ready to make your investment in Morocco? Contact DBS Morocco today and take the first step towards a profitable and secure investment in one of Africa’s most promising markets!